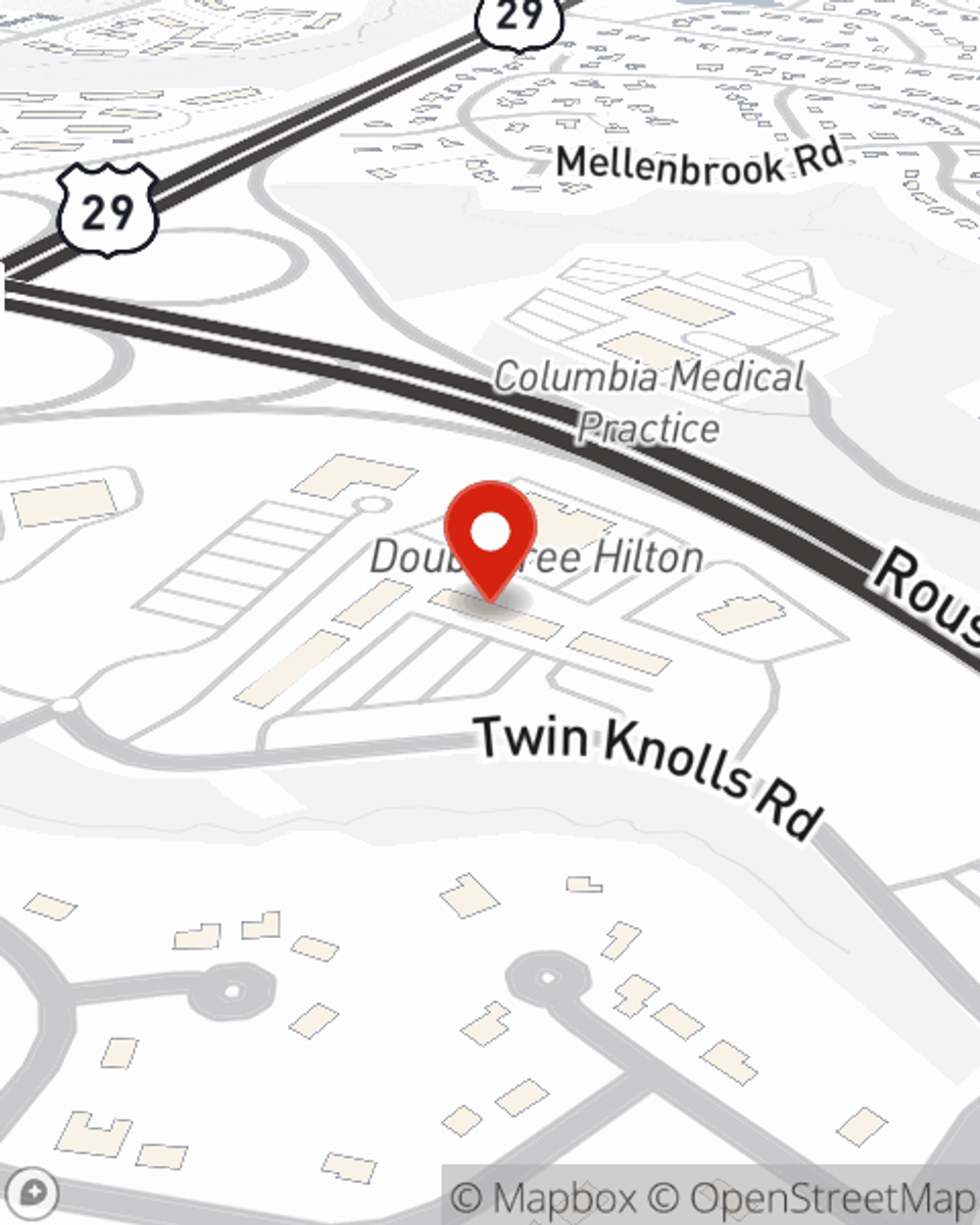

Renters Insurance in and around Columbia

Welcome, home & apartment renters of Columbia!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Columbia

- Howard County

- Ellicott City

- Odenton

- Catonsville

- Elkridge

- Laurel

Home Is Where Your Heart Is

Your rented condo is home. Since that is where you spend time with your loved ones and make memories, it can be advantageous to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your smartphone, table and chairs, bed, etc., choosing the right coverage can help protect you from the unexpected.

Welcome, home & apartment renters of Columbia!

Renters insurance can help protect your belongings

There's No Place Like Home

It's likely that your landlord's insurance only covers the structure of the home or condo you're renting. So, if you want to protect your valuables - such as a tablet, a set of favorite books or a stereo - renters insurance is what you're looking for. State Farm agent Carrie Skinner has the knowledge needed to help you evaluate your risks and protect yourself from the unexpected.

Reach out to Carrie Skinner's office to see how you can benefit from State Farm's renters insurance to help keep your personal property protected.

Have More Questions About Renters Insurance?

Call Carrie at (410) 772-5925 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Carrie Skinner

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.